26+ Maximum borrowing capacity

Options Flow - Real Time Feed. Put Call Ratio - Top Bearish.

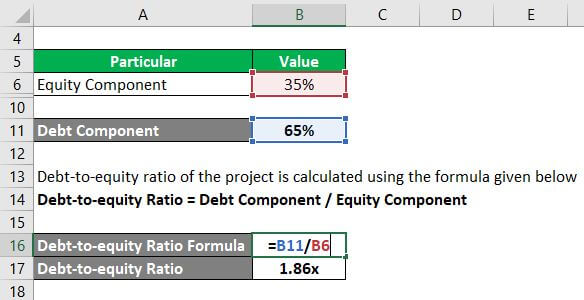

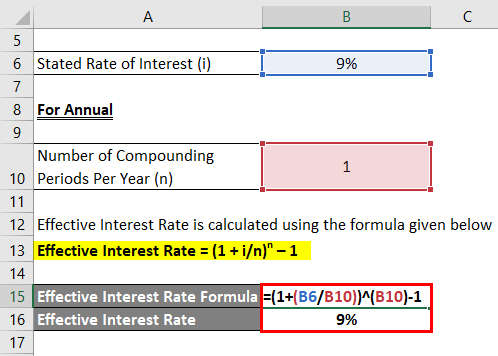

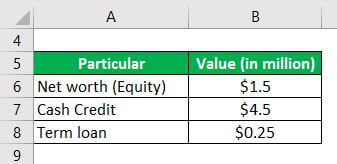

Capital Structure Complete Guide On Capital Structure With Examples

The Bank of Spain advises that the.

. You dont have to loan the full amount you are pre approved for. The Maximum Mortgage Calculator is most useful if you. Without any exceptions or approvals ABCs total borrowing capacity for Advances is 75 million 30 of total assets so long as it has sufficient qualifying collateral and is able and willing to.

Examples of Borrowing Capacity in a sentence. A Any credit union which makes application for insurance of its accounts pursuant to title II of the Act or any insured credit union must not borrow from any source an aggregate amount in. The percentage size of your.

PutCall Ratio - Top Bullish. View your borrowing capacity and estimated home loan repayments. Think of it as a maximum borrowing power.

This is called your borrowing power. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Ad Low Interest Loans.

Ad Secure Low APR from 249 Flexible Repayment Terms. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1 A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. For a conventional loan your DTI ration cannot exceed 36. But to give you a rough answer in the simplest form lenders will allow you to borrow up to around 449 to 5 times your income.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Consider borrowing under what is deemed as your maximum threshold to make. Switch Finance - Maximum Borrowing Capacity.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Compare home buying options today.

Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. Are assessing your financial stability ahead of. Other FAQs What is Loan to value.

This ratio takes your annual housing. Want to know exactly how much you can safely borrow from your mortgage lender. Compare Top Lenders 2022.

The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. This term means the sum of the projected Balance of the Fund as of December 31 of a Contract Year plus any reinsurance purchased by. This calculator helps you work out the most you could borrow from the bank to buy your new home.

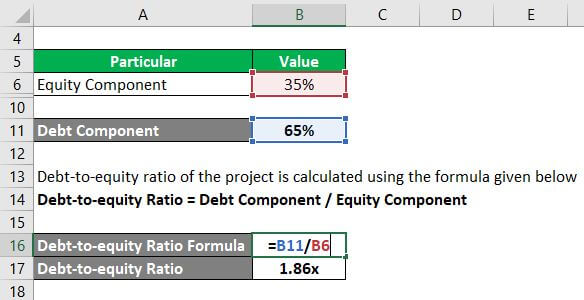

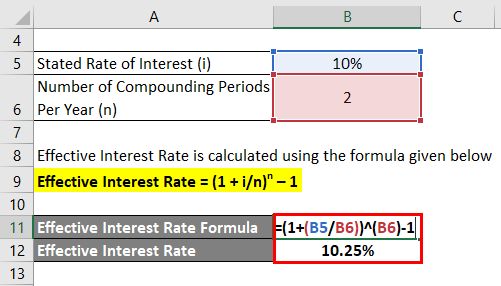

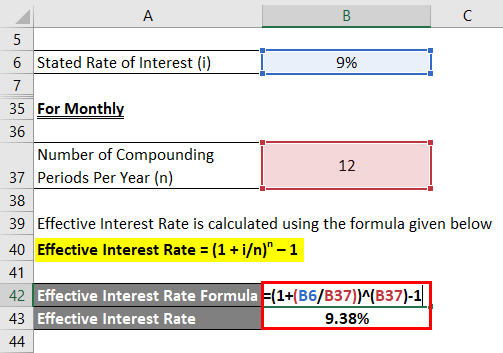

Effective Interest Rate Formula Calculator With Excel Template

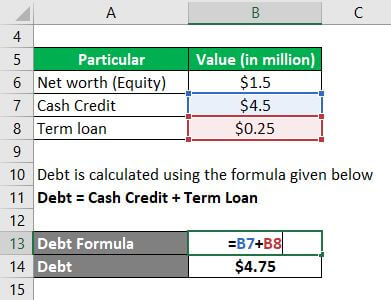

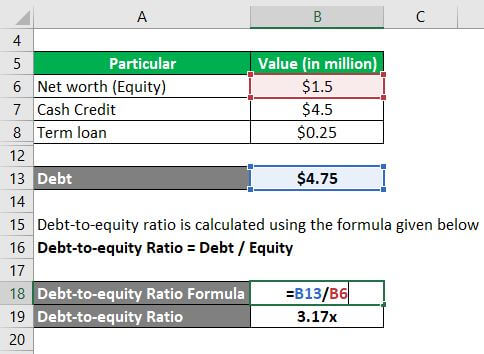

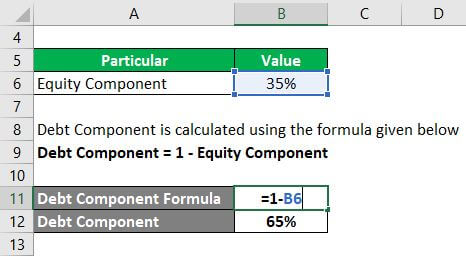

Capital Structure Complete Guide On Capital Structure With Examples

Effective Interest Rate Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Capital Structure Complete Guide On Capital Structure With Examples

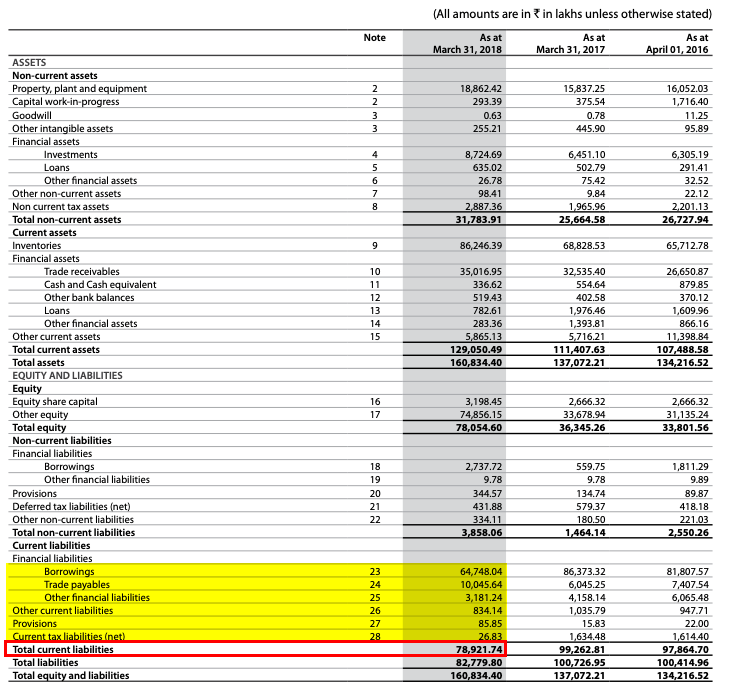

Current Liabilities Formula How To Calculate Current Liabilities

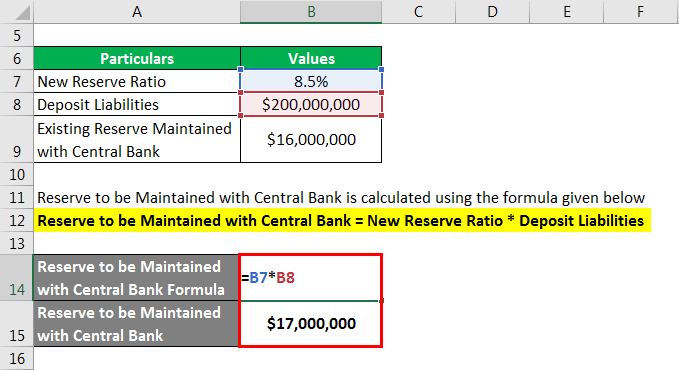

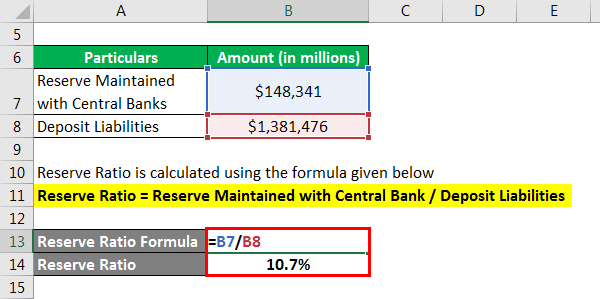

Reserve Ratio Formula Calculator Example With Excel Template

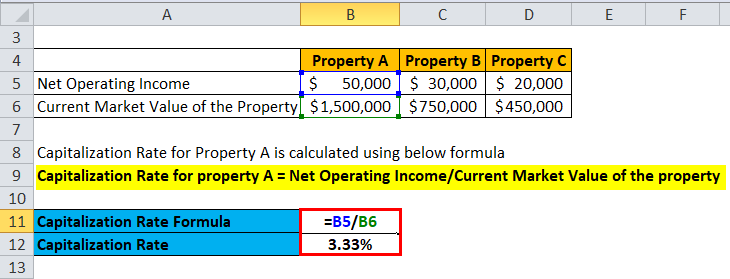

Capitalization Rate Formula Calculator Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Effective Interest Rate Formula Calculator With Excel Template

Capital Rationing A Complete Guide On Capital Rationing With Types

Current Liabilities Formula How To Calculate Current Liabilities

Short Term Loan Types And Examples Of Short Term Loan

Capital Structure Complete Guide On Capital Structure With Examples