42+ calculate mortgage interest tax deduction

Homeowners who bought houses before. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Mortgage Interest Tax Deduction What You Need To Know

Built-in interest calculations for all federal and state jurisdictions with income taxes.

. Web A mortgage calculator can help you determine how much interest you paid each month last year. Web If youve closed on a mortgage on or after Jan. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web March 5 2022 246 PM. Web Calculate Interest payment as shown below. You can claim a tax deduction for the interest on the first.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. How It Works in 2022 The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers.

Web The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Use this calculator to see how much you could save.

Web The IRS lets you deduct interest paid on your mortgage from your taxes as long as you itemize. Taxes Can Be Complex. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt. Ad Accurately determine interest on federal and state tax underpayments and overpayments. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

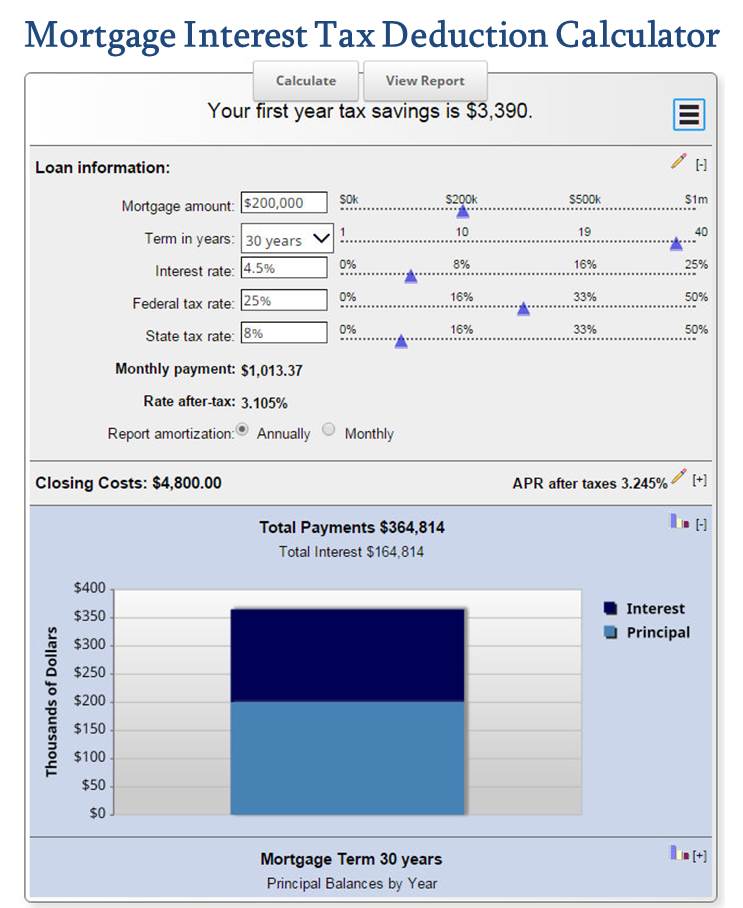

However the deduction for mortgage interest. The interest paid on a. Web With the mortgage tax deduction calculator you can get an idea of exactly how much youll be able to deduct from your taxes each year through your mortgage.

Yes you can include the mortgage interest and property taxes from both of your homes. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

Web Is mortgage interest tax deductible. Lets say you paid 10000 in mortgage interest and are. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web This form will state exactly how much you paid in interest and mortgage points over the course of the year and act as proof that youre entitled to receive a. Web Mortgage Tax Calculator.

As of 2018 youre allowed to deduct the interest on up to 750000. Web Mortgage-Interest Deduction. 750000 if the loan was finalized after Dec.

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Taxes Can Be Complex. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. So the total Interest that is 1000000 5. Discover Helpful Information And Resources On Taxes From AARP.

Web The mortgage interest deduction is a key tax provision that allows millions of homeowners to offset the mortgage interest paid each year against taxable income. However higher limitations 1 million 500000 if married.

Home Loan And Financial Services Experts In Tweed Heads Mortgage Choice

Gutting The Mortgage Interest Deduction Tax Policy Center

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Pdf Policy Responses To Low Fertility How Effective Are They

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Can A Personal Hybrid Loan Help Build Credit Moneylion

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Pdf Policy Responses To Low Fertility How Effective Are They

Mortgage Tax Deduction Calculator Freeandclear

Qidldpdhuezghm

Mortgage Payment Tax Calculator Deduction Calculator

Keep The Mortgage For The Home Mortgage Interest Deduction

Business Succession Planning And Exit Strategies For The Closely Held

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Business Succession Planning And Exit Strategies For The Closely Held

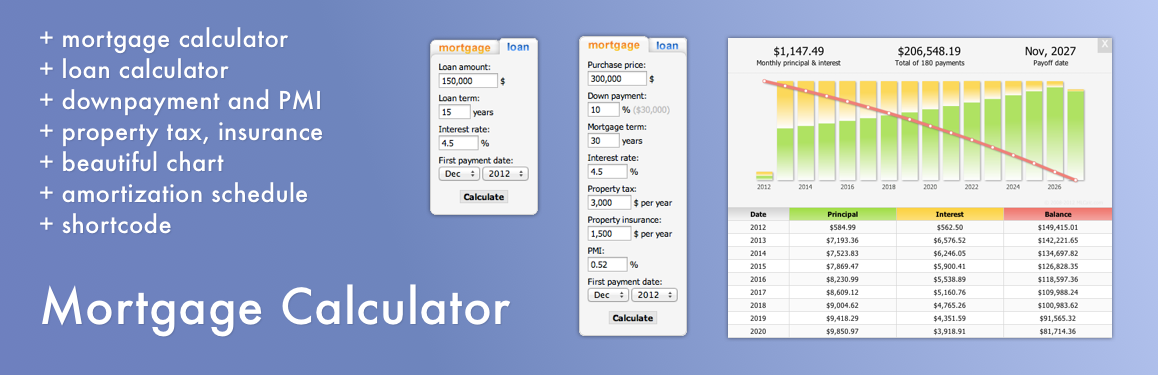

List Of 7 Useful Wordpress Calculator Plugins 2023 Engine Templates